1. To Switch or Not to Switch?

A mortgage rate comparison from a broker could save you hundreds if not thousands each year after making a simple mortgage switch. Not enough mortgage holders in Ireland take advantage of the benefits of a mortgage switch. Some of the reasons to switch your mortgage include:

- Reduce your mortgage term

- Make home improvements or release equity

- Reduce your monthly repayments

- Lock into a fixed rate in the face of rising inflation

Rising Inflation

Inflation in Ireland is rising rapidly in 2021 which means that variable mortgage rates are likely to increase in the near future. Prices on average, as measured by the CPI, were 5.1% higher in October compared with October 2020. This is the largest annual increase in prices since April 2007 (+5.1%) (Source: CSO Ireland)

Fixed Rate Mortgages

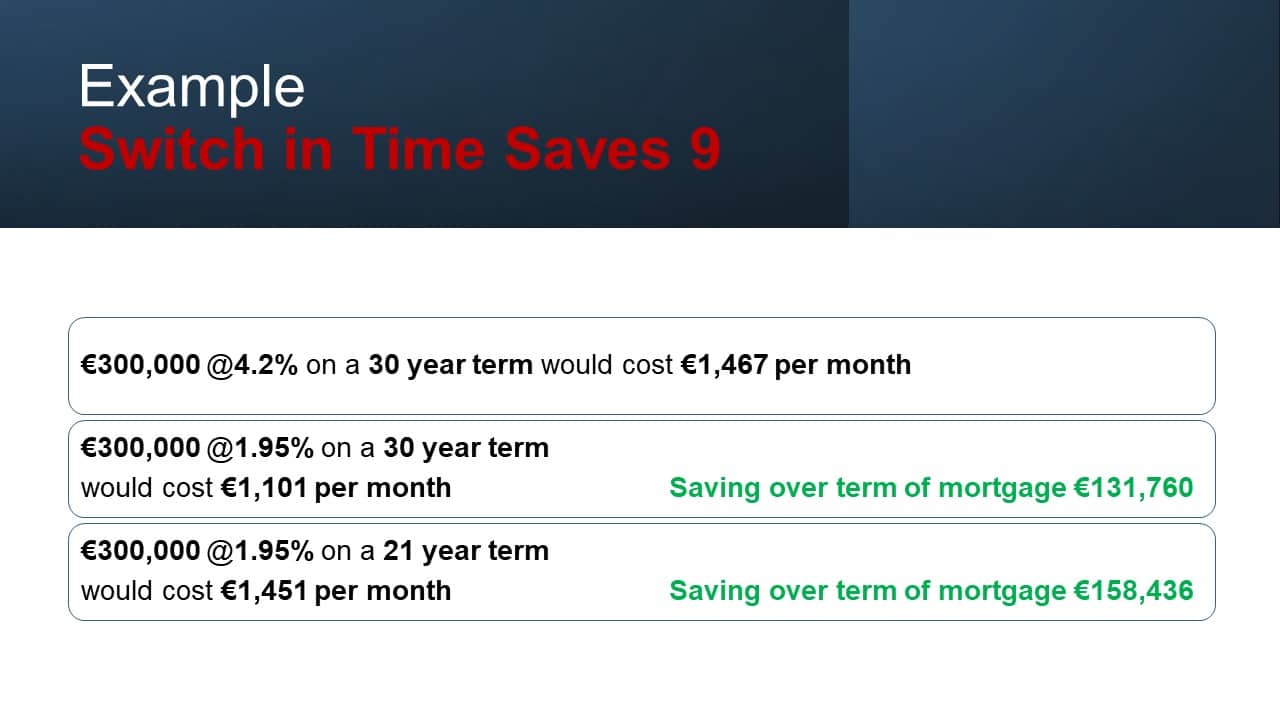

In 2021, fixed mortgage rates hit a record low (1.95%, 7 year-fixed, LTV <60%) married with the introduction of long-term fixed rates by lenders like Avant Money and Finance Ireland. Consumers in Ireland can lock their mortgage rate for 15, 20, 30 years at very reasonable mortgage rates. Read more in our blog post Lock into a 30-Year Fixed Rate Mortgage for Certainty and Peace of Mind! There are also some great 3 to 7 year fixed products available.

2. Documents Required to Switch Your Mortgage

At Mortgage123, we specialise in comparing rates on the market and getting you a fast and easy mortgage switch approval. You do however have to do some initial work and gather documents to get you switch started, details of these will be provided by your Broker as they vary from Lender to Lender.

3. Legal Expenses Associated with a Mortgage Switch

Same as a new mortgage, a switcher mortgage needs to pass through the legal route.

Thankfully, when it comes to switching, the cost and workload for the solicitor is about half of what it is when buying a new property.

Most of your legal costs will go on your solicitor’s professional fee, with some extra euro going on his/her outlays, associated costs and, of course, VAT. Here’s a summary of what they’ll do for their fee:

- First, your solicitor will request the deeds to your home from your old bank and act as the point of contact with your new bank for the switching process.

- Your solicitor will then invite you in for a consultation to go through the loan offer from your new bank and to advise on any questions or concerns you might have.

- If you’re happy to proceed with the switch, you’ll sign a new loan agreement, which your solicitor will send to your new bank. If you wish to add a new name to the title deeds of your home, your solicitor can help with that too.

We can recommend solicitors who charge as little as €800 plus VAT and disbursements.

Although not strictly a legal fee, there is always a valuation fee associated with switching mortgage too, which will cost you around €150.

Some mortgage providers extend money towards legal expenses. Your mortgage advisor will be able to give you information on current offers. Such as €5,000 Cashback.

If you are paying over 3% on your mortgage, it is time to search around!