Current Flex rates as of 10th June 2025:

2.98% for Loan-to-Value equal or above 80%

3.18% for Loan-to-Value less than 80%

The Irish mortgage market welcomed Avant Money’s Flex Mortgage in April 2025. This mortgage combines the benefits of a low variable mortgage rate and a one year fixed rate. Furthermore, the rate is directly linked to an external reference interbank borrowing rate (Euribor).

Who is this mortgage for?

- You want to be on the lowest mortgage variable rate in Ireland, but also set for 12 months

- You appreciate the transparency of a variable rate linked to an external index (Euribor)

- Flexibility to overpay or redeem your mortgage without any penalty

- Flexibility to switch to a fixed rate at any time

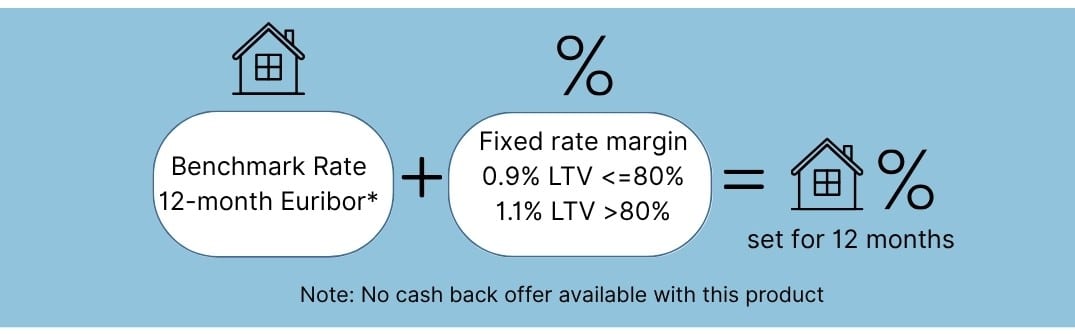

How is the Flex mortgage rate calculated?

The interest rate comprises two components: a benchmark rate linked to the 12-month Euribor and a fixed margin, which remains constant throughout the mortgage term. The rate is adjusted annually for each client based on the 12-month Euribor. This provides borrowers with a predictable repayment schedule for the following year.

Benchmark rate

Euribor (Euro Interbank Offered Rate) is the benchmark interest rate at which European banks lend to one another in the interbank market. It is a key reference rate used to determine interest rates for mortgages, loans, and savings accounts across the Eurozone. The Euribor is published on European Central Bank Website.

Key Facts About Euribor:

- Published Daily: The rate is calculated and published every business day by the European Money Markets Institute (EMMI).

- Varies by Term: Euribor rates exist for different loan durations, such as 1 week, 1 month, 3 months, 6 months, and 12 months. The 12-month Euribor is the most commonly used for mortgage interest rates.

- Influenced by ECB Policy: The rate is closely linked to decisions made by the European Central Bank (ECB), which adjusts interest rates to control inflation and economic growth.

*Note: A 0% floor rate applies when Euribor rate is negative.

Interest rate margin

The margin is determined by the Loan-to-Value ratio of the mortgage.

Loan to Value (LTV) <=80%

Benchmark Rate + 0.9%

Loan to Value (LTV) >80%

Benchmark rate + 1.1%

Key features of the Flex variable mortgage rate:

- Low Variable Rates: Since October 2023, the Euribor benchmark rate has been trending down. The Flex mortgage rate is set at a fixed margin above the 12-month Euribor making it the lowest variable rate on the market right now.

- Transparency: The interest rate is directly linked to the 12-month Euribor, an external reference rate published by the European Money Markets Institute. Avant Money will update the variable mortgage rate on 10th of each month in line with the Euribor rate. This linkage ensures that rate adjustments reflect current market conditions.

- Flexibility: Borrowers have the option to make overpayments at any time without incurring penalties. Additionally, they can switch to another mortgage product without exit fees. However, there is no guarantee that the Flex Mortgage will still be available at the same conditions after switching.

It’s important to note that while the Flex Mortgage offers the advantage of potentially lower rates and repayment flexibility, the variable nature of the interest rate means that repayments could increase if the Euribor rate rises.

Will the Euribor rate reduce in 2025?

Looking ahead, major financial institutions anticipate further reductions in the Euribor rate during 2025 and further. For instance, Bank of America, Goldman Sachs, and Citigroup project additional rate cuts throughout the year, potentially bringing the ECB’s benchmark rate below the neutral range of 2% to 2.5%. Given that the Euribor rate often mirrors the ECB’s benchmark rates, these anticipated cuts suggest a continued downward trend for the Euribor in 2025.

It’s important to note that these projections are subject to change based on economic conditions, inflation trends, and monetary policy decisions. While current forecasts indicate a potential decline or stabilization of the Euribor rate, actual movements will depend on various macroeconomic factors throughout 2025.

How to apply?

The Avan Money Flex Mortgage is available through select mortgage brokers. Mortgage123 is amongst the firms offering this new product from April 1st, 2025.