The derelict house grant or the Vacant Property Refurbishment Grant was launched on 14 July 2022. We are getting enquiries for mortgages to purchase such properties. However, securing a mortgage for the purchase of a derelict/vacant building may not be straightforward. Furthermore, you have to be clear how the Grant works exactly and what is covered.

Vacant Property Refurbishment Grant Criteria

The grant of up to €50,000 will apply to qualifying vacant properties in cities, towns, villages and rural parts of the country. There are rules that apply if you want to avail of this grant:

- The property must be vacant for two years or more and built before 1993.

- Proof of ownership will be required to support the grant application.

- The property must remain your principal private residence for at least 10 years after the work is completed.

- You must be selling or have sold your previous / current property in order to avail of this grant.

- You must have tax clearance from Revenue and your tax affairs must be in order.

- You must have paid your local property tax, if applicable.

- The grant must be approved before any work begins.

Works the Grant Will Cover

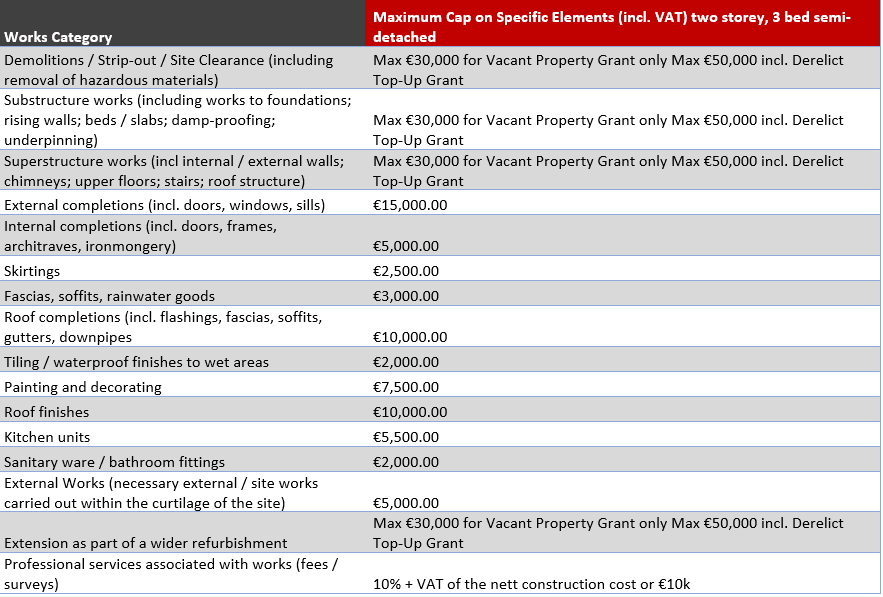

As seen from the table below, there is a maximum cap on specific works, unfortunately. When and if carrying out works, keep the maximum amount in mind that you will receive back from the grant.

Steps to avail of the Grant

- Proof of Vacancy – You will provide the grant payment utility bills to confirm vacancy such as pattern of usage or disconnection.

- Proof of Ownership – You need to provide proof of property ownership.

- Technical Visit – The Local Authority will arrange a visit to your property to ensure it is possible to do the work and check the estimated costs of the planned works.

- Confirmation – The local authority will write to let you know if your application has been successful and how much of a grant has been approved

- Agreement – You will sign an agreement containing the clawback agreement including a charge on the property.

- Proof of works – You will provide the authority with an invoice for the completed work. They will arrange for a technical staff to visit the property and confirm the work is completed.

- Receive Payment – The Charge document must be signed and the grant will then be paid out.

What Could Be the Problems?

There are two main problems with purchasing a derelict building. One, getting a mortgage to purchase it and two, funding and completing the works.

Securing a Mortgage

Note that you will not get a mortgage on a property you can’t live in with a view to doing work at some point in the future. It is important to establish if the property is habitable. There are two types of house renovations, structural and non-structural. They are very different when it comes to mortgages. Read our blog on Mortgages for House Renovations here.

The difficulty in getting a mortgage for a derelict house can make this type of grant only attractive to people who say inherited a property that was only vacant for a few years and just want to do some cosmetic work. Or, a select few who have a piggybank full of cash lying around.

Extent of Renovation Works

The longer a house is derelict or vacant for, the more potential problems you may face i.e. dampness due to poor ventilation and lack of or no electricity, or no septic tank on site. There is a maximum cap on specific works, i.e. €10,000 on roof finishes. If a derelict property requires a new roof (which is highly likely if it was derelict for many years) you will need a large sum of savings up front to cover the cost. This cost may only be partially covered by the grant. Proceed with caution, extensive renovations can often run over budget.

Q & A

We have received a lot of questions from our followers on our Instagram page.

As a result of the increased interest in this grant, we have compiled a list of our most common questions. Continue reading to see some of the questions we received in relation to the derelict house grant.

How much can I receive?

A grant of up to a maximum of €30,000 is available. This is solely for the refurbishment of vacant properties for occupation as a principal private residence.

If the costs are expected to exceed the standard grant of up to €30,000, a maximum top-up grant amount of up to €20,000 is available.

How do I apply?

You can apply for the grant by submitting an application form to your local authority.

When Do I Receive the Grant?

The fine print

The monies for the renovation will not be released until the works are done. This is called a hold back which means you will have to fund any upgrade up front. You then get the money back from the local authority once works are complete and they have been inspected.

As proof of works is required in the grant application, you will only receive the derelict house grant AFTER all work has been completed and the property was inspected by your local authority. As a result, it is important to have funds secured to carry out the works.

Will this be an Effective Grant?

Only time will tell how effective the new grant will be. It is evident that the grant favors those who have large savings and time on their hands as works need to be paid for up front before receiving the grant.

The big question is whether the house you are looking at is habitable? Does it have a working kitchen, bathroom, water, heating, etc. If it is not habitable, then your only option is to try and get your mortgage provider to lend the funds to do the work. If the building works are going to be very extensive, the mortgage can be treated as a self-build which has different requirements and draws down in stages.

Are You Thinking of Buying a Home?

If you have any further questions, our brokers are here to help and will provide support and advice. Contact us today on (061) 599990.